Effective January 1, 2025, the AB-5 change in law applies to manicurists.

〰️

Effective January 1, 2025, the AB-5 change in law applies to manicurists. 〰️

AB-5 Resources

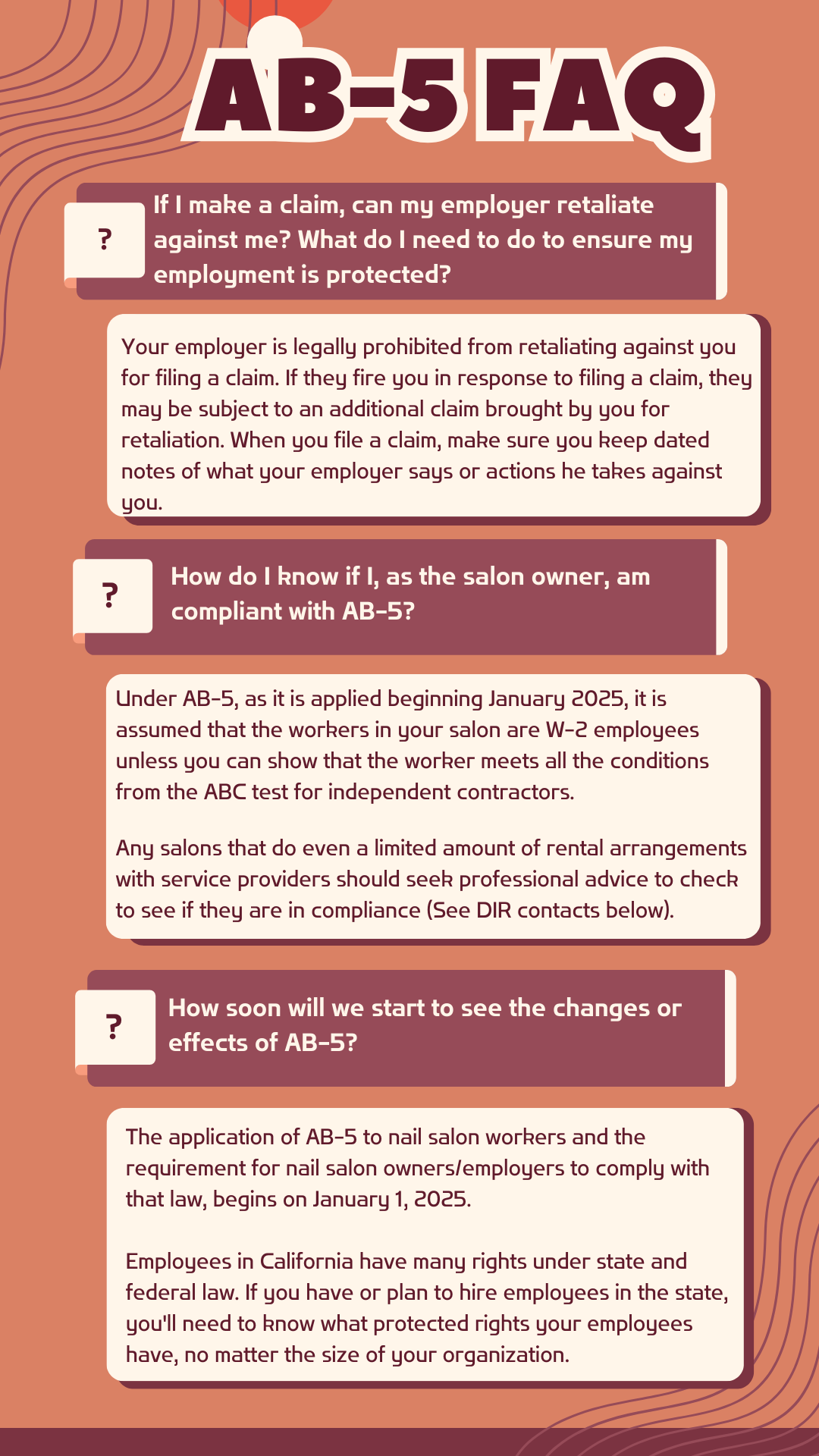

This information is directly from the Division of Labor website. This FAQ is to help inform you and your community about the AB-5 change in law, effective January 1, 2025. CHNSC cannot provide any legal or financial advice regarding employment concerns; however, we have provided a list of agencies that you can contact. You can access or download the PDF version of this FAQ here. For any general questions, please email info@cahealthynailsalons.org.

Photo by Madelyn Le

What To Know

Actions You Can Take

~

Actions You Can Take ~

AS A MANICURIST…

As a manicurist, you can speak to a lawyer or notable workers’ rights agencies to see whether you are classified appropriately as a W-2 worker.

As a manicurist, you can file a claim as someone misclassified as an independent contractor instead of a W-2 employee.

AS A NAIL SALON OWNER…

As a nail salon owner, you can speak to your lawyer or notable workers’ rights agencies to see if you are in compliance with AB-5 or seek legal advice to take the necessary steps to ensure you’re in compliance with the laws around AB-5.

RESOURCES

Board of Barbering and Cosmetology

For questions regarding a complaint, you can email BBCEnforcement@dca.ca.gov

For general licensing questions, you can email barbercosmo@dca.ca.gov

For further contacts: https://www.barbercosmo.ca.gov/about_us/contact_us.shtml

Department of Industrial Relations

Labor Commissioner’s Office: File a wage or retaliation claim, public works questions, report a labor law violation or other questions about labor laws: (833) 526-4636

Contact Page DIR: https://www.dir.ca.gov/Contactus.html

CA Healthy Nail Salon Collaborative

Learn more about our org: https://www.cahealthynailsalons.org/

For any inquiries, contact us at info@cahealthynailsalons.org

other ab-5 FAQs

-

You can report or make a claim to the Department of Labor Commissioner's office:

El Centro:

(760) 353-0607

Long Beach:

(562) 590-5048

Los Angeles:

(213) 620-6330

San Bernardino:

(909) 383-4334

San Diego:

(619) 220-5451

Santa Ana:

(714) 558-4910

Van Nuys:

(818) 901-5315

-

You can report or make a claim to the Department of Labor Commissioner's office:

Bakersfield:

(661) 587-3060

Fresno:

(559) 244-5340

Santa Barbara:

(805) 568-1222

Stockton/Lodi:

(209) 948-7771

-

You can report or make a claim to the Department of Labor Commissioner's office:

Fresno:

(559) 244-5340

Oakland:

(510) 622-3273

Redding:

(530) 225-2655

Sacramento:

(916) 263-1811

Salinas:

(831) 443-3041

San Francisco:

(415) 703-5300

San Jose:

(408) 277-1266

Santa Rosa:

(707) 576-2362